This week, I am writing from the Roccatederighi in Tuscany. What got into my attention this week most are two stories from The Economist. The first one is about how big are the trading desks in big oil companies. Second one about the differences in compensations across the world in CEO’s positions.

The big oil’s trading desk

bp, Shell and TotalEnergies have been silently expanding their trading desks since the early 2000s, says Jorge Léon of Rystad Energy, a consultancy. In the first half of 2023 trading generated a combined $20bn of gross profit for the three companies, estimates Bernstein, a research firm. That was two-thirds more than in the same period in 2019, and one-fifth of their total gross earnings, up from one-seventh four years ago.

The Economist, Why big oil is beefing up its trading arms, October 19th 2023

Estimating that trading is around 20% of earnings for the oil producers is a huge number. It makes some inspiration for myself to improve the stage of trading desk into our family business.

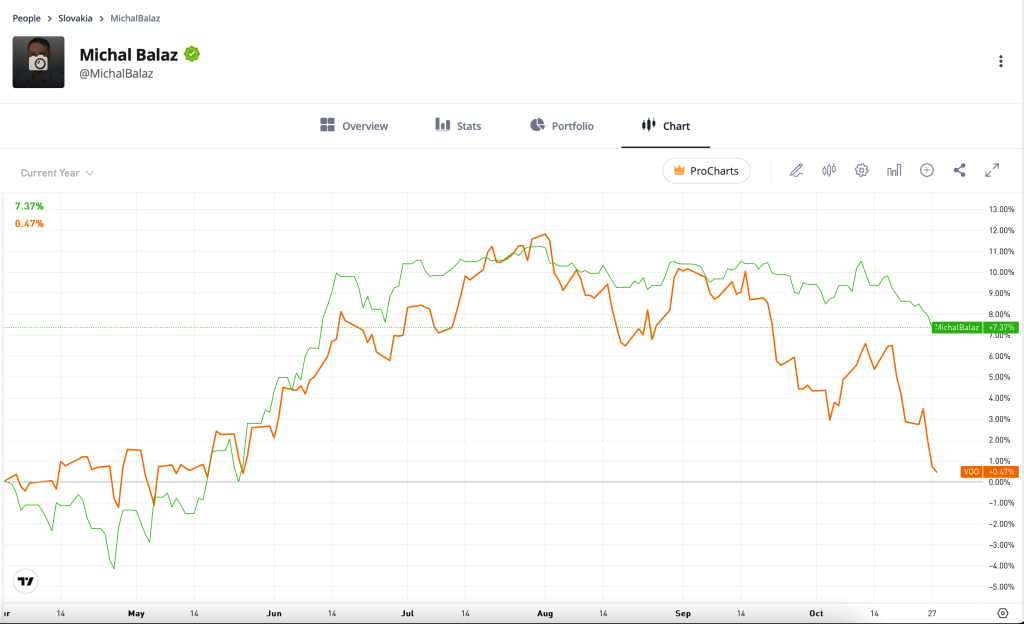

Our “trading desk” is far less impressive – we made from trading only about 1,6% of our gross earnings in the first half of this year. As you can see, it is not so bed comparing to Vanguard S&P 500 index. This good results are partially possible due to unloading of some big names from the portfolio during tax season. We run into liquidity issues and thus we needed to unload our investment before our time targets (holding the investment over 1-year for having tax free income).

CEOs compensations

The typical s&p 500 boss earned more than $14m last year, according to figures from MyLogiq, a data provider. That is around 250 times as much as the average worker. It is also more than bosses earn in Britain (where chiefs of ftse 100 firms took home just shy of $5m), let alone in France and Germany (where ceos are paid still less). Some American corporate chieftains rake in many times that. In 2022 Sundar Pichai of Alphabet, a tech titan, received a $218m stock award, following a similar-sized bounty in 2019.

The Economist, Are America’s CEOs overpaid?, October 17th 2023

This is just a reflexion how inequality defines the same position in the world. Even thou this seems to me quite fair. U.S. is a big market with stock exchange developed so far, that almost everyone is investing there. We should be not surprise that CEO in S&P 500 company is getting 3x or more in average home than in Europe or U.K.

And the last one in from the front of the Fontana del Nettuno.

You must be logged in to post a comment.